In the last year alone, I’ve helped 200+ European founders raise hundreds of millions in San Francisco as part of Entrepreneurs First. The rounds are at valuations they could only dream of back home and often done within a matter of days.

The Bay Area is the world’s tech epicenter. The streets may be paved with gold, but it’s also brutally competitive. I want European founders not just to survive here, but to thrive.

Fundraising in the U.S. is different to fundraising in Europe – probably more than you realize. VCs will ask different questions and expect different answers. This post breaks down some of my most important observations and gives advice on what you need to do differently.

Some of Silicon Valley’s biggest companies were built by Europeans; why shouldn’t you be next?

How to land your pitch in SF

If you’re coming from a European context, you will need a different style and tone of pitch compared to what you’re used to. Let’s go through the high notes you need to hit to smash your seed raise.

Speed is ambition made visible

One of the most common tropes about U.S. vs. European startups is “Europeans lack ambition.” Too often, European founders try to fix this with a lofty vision statement or inflated market size.

But ambition isn’t a slide in a deck, it’s a mindset. It’s not just about a dazzling long-term vision (though that helps), it’s about how you show up in everything you do.

Ambition isn’t just about what you could achieve, it’s about what you’re achieving right now. When I ask seed investors what they look for in founders, the most common answer is speed (also called velocity, productivity, pace, or intensity). Ambition shows up in how fast you move.

One of the biggest criticisms of European founders is that they’re too methodical and careful with product development and delivery. Compared to their U.S. peers, they simply move slower and more cautiously.

Fast product development drives fast learning. Fast learning accelerates PMF and capital efficiency. Investors want to see “lines, not dots”: evidence of how quickly you’re progressing, not a static snapshot. Meeting VCs before you’re ready can give them a negative data point to draw the wrong line. You want to control the story they hear.

As one VC put it: “The best teams make insane amounts of progress between each meeting or email, often within just a couple of days.” The speed of company building has never been faster, you need to show that you aren’t just keeping up, but that you’re setting the pace.

Most startups have very limited defensibility. Your momentum is your moat.

Things to say:

- “Since our launch, 4 weeks ago, we’ve generated $X MRR”

- “This week we’ve [insert 3 insanely impressive things you’ve made happen]”

- “In the next two weeks we will close 1 more customer, make 2 hires, and release the next version of our product – and we’re only a team of 2”

Things not to say:

- “We first incorporated 6 months ago and since then have made $X MRR”

- “Over the next quarter we plan to…”

Make sure you read this post by Sarah Guo, founder of Conviction VC, on pace.

$ Pitch profits $, not products

So how do you communicate your big vision?

European founders often talk about changing the world; lives saved, children educated, deep social impact. It’s powerful, but it’s missionary, not mercenary. U.S. investors want to hear how you’ll dominate and expand a market and generate extreme profits. They’ll only invest if they believe you can make them a lot of money i.e., hundreds of millions of dollars.

Some tips:

- Lead with the size of your market and be specific. Don’t wave your hands with “our TAM is $1 trillion.” Show your bottom-up numbers. (Mike Vernal’s post at Sequoia on this is excellent.)

- Don’t frame your product as a cost saver, that caps your market size. Frame it as a market maker. Show how you help customers expand their markets and make more money.

- Be ready to answer: How do you get to $1M ARR? How do you get to $100M ARR? How do you get to $1B ARR? How fast can you get there and how ambitious can you be about that speed?

- Understand the “idea maze” of your market. SF VCs have a deep, nuanced understanding of most market mazes. You need to do the work to know the history, in particular why similar ideas have or haven’t worked before.

- And finally: What’s your secret? What do you know that others don’t? Peter Thiel coined the phrase Secret in his book Zero to One and you can see my explanation of how to find a secret here.

Pitch what’s possible, not what’s probable

A U.S. VC who works with European founders told me their most common mistake: being too “realistic” with sales numbers. They pitch what they think will happen instead of what could happen.

When U.S. VCs see projections from American founders full of possibility, a measured European forecast can look timid, or worse, make them wonder if you know something worrying about the market.

The answer isn’t to hype numbers you don’t believe. It’s to ask: “What’s the most ambitious target we could hit and what would it take to get there?” Then pitch that. Pitch the possible, not the probable.

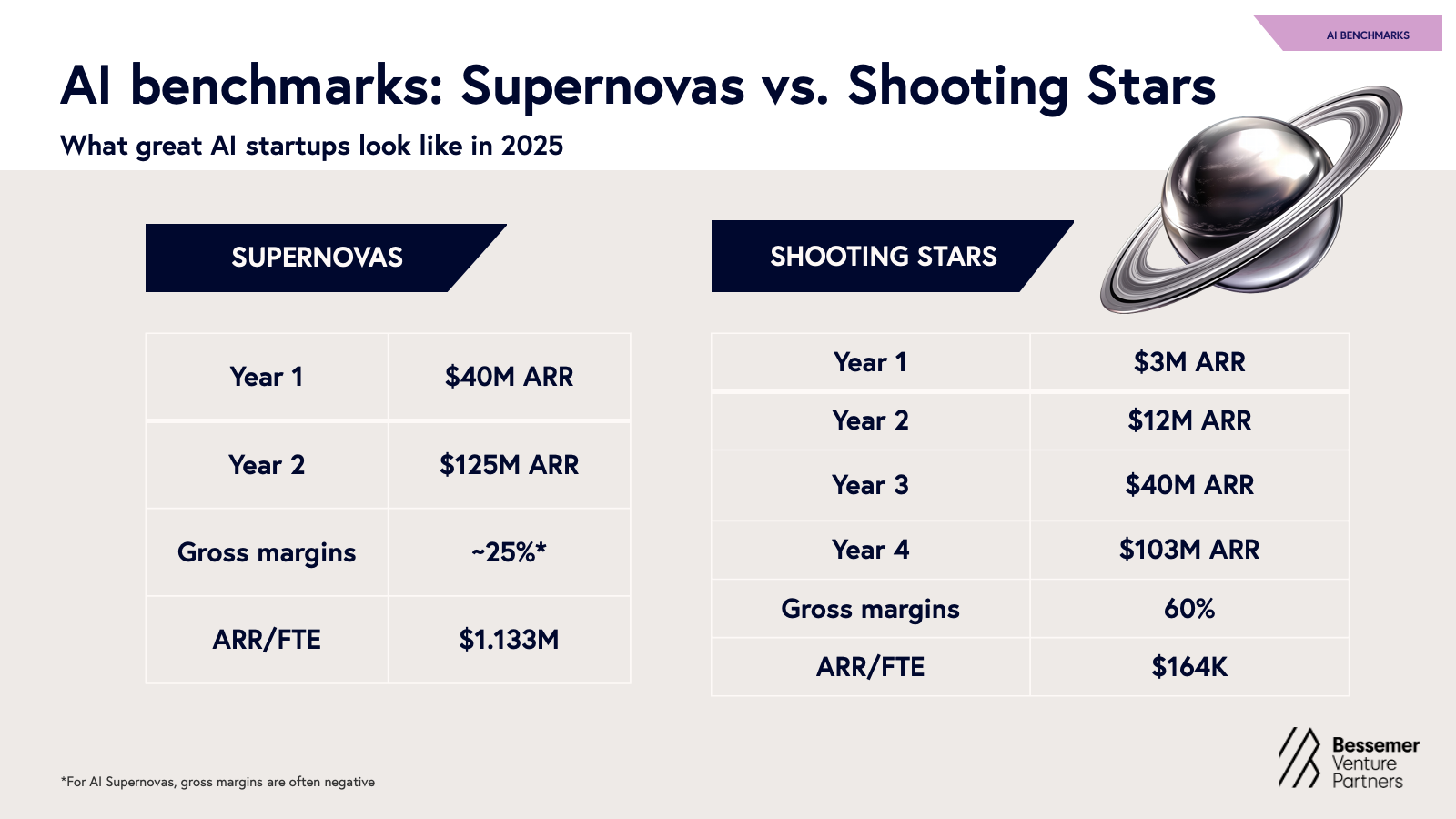

To give you some benchmarks: Lovable hit $30M ARR in two years; Mercor hit $75M ARR in two years.

Bessemer shared their view that the top performing AI SaaS, the ‘Shooting Stars’ “reach the ~$3M ARR range within their first year of revenue while quadrupling in YoY growth with ~60% gross margins, and ~$164K ARR / FTE in their first years.” Read more here. We’ve seen this kind of growth in our portfolio; this is what it takes to be a top performing AI startup today.

Are you all-in on the U.S.?

You need a simple story for what you’re doing in the U.S.; where you’re based, why you’re there, and how you’re going all-in. Without a clear U.S. plan, it’s much harder to get U.S. VC money at seed.

You need to show that you’re fully committed to the U.S.. Be ready to answer:

- Where will your team be based?

- What’s your U.S. relocation plan?

- How quickly can you permanently be here?

- How will you secure your O-1 visa? What visa firm are you using?

Some VCs won’t even meet founders until they have the right to remain in the U.S.. Yet it’s also easier to get your O-1 after your round closes. Make sure you know your plan and can communicate it crisply.

It’s worth using a visa firm such as Plymouth to help you navigate the O-1 process.

“The O-1 visa is much more accessible than founders often expect. Many are already qualified and for those who aren’t yet, eligibility can be boosted through steps like judging hackathons or securing press about their startup.” Lisa Wehden, founder and CEO of Plymouth

Badges ≠ credibility: U.S. investors don’t understand your European accolades

This is a tough one: the badges and logos you’ve worked so hard to get on your team slide often won’t translate to a U.S. VC audience. They may not know your university, or if they’ve heard of it, they won’t know how good it is. They may not know the companies or startups where you built your experience.

Be ready to sell why your background is impressive. Don’t assume the same level of knowledge or context you’d get from a European audience. Spell it out for them.

What was your childhood like?

You may be surprised by how personal some of the questions you get from VCs are.

Many SF VCs quietly look for evidence of resilience and they believe serious early challenges help forge it. You should be prepared for questions that can feel unusually personal.

Prepare your personal story that highlights how you’ve taken unconventional paths, risen above your peer group, and dealt with adversity. This isn’t about oversharing private pain, it’s about showing grit, resourcefulness, and the ability to overcome obstacles.

For example:

- Tell me about your relationship with your father?

- Where do you get your motivation from?

- What was your childhood like?

“Most of the VCs I spoke to focused on the business, but some spent the entire time focusing on childhood trauma. It’s worth being prepared!” French founder that raised in SF

DM velocity = data

Everything is data while raising your seed round. Investors will pay very close attention to how quickly you respond to emails and messages. You need to have a 1-60 minute turnaround time at all times between 7am-11pm, 7 days a week.

This shows that you are on top of your fundraise and are a high velocity founder who can get a ton done, even while juggling a raise and building your company.

I’ve had VCs messaging me an hour after they’ve sent an email or message to a founder asking why they haven’t replied yet. We’ve seen teams lose Tier 1 VC interest because they didn’t reply to their email that day. This may be the easiest way for founders to screw up their fundraise when they don’t understand the cultural norms of the Bay Area.

At seed, you’ll raise on a SAFE and you’ll get the money the same day

In Europe, you’ll typically do a priced round with a lead investor. In the U.S., you’ll often raise on a SAFE, frequently as a party round with multiple investors.

Y Combinator developed the SAFE as a very founder-friendly way to raise seed capital. You can read all about it here. One of the particular benefits is that you can run a ‘rolling’ raise where you can get money in the bank the day you sign each SAFE.

Lenny’s newsletter explains “You don’t need a lead investor to start taking on capital in a seed round. In fact, it is often better to open a SAFE (simple agreement for future equity) at reasonable valuation and start collecting the checks of smaller angels while you are having conversations with larger funds. Not only will you be taking on capital, but you’ll build social proof for the larger investors.” You can read the rest of this excellent post on raising here.

That’s a wrap

I’ll be continuing to post about how Europeans can nail their fundraises in the Bay Area, so make sure you subscribe to our substack.